Broadcom Stock Price Analysis

Broadcom stock price today – This analysis provides an overview of Broadcom’s current stock price, recent performance, influencing factors, and comparisons with competitors. The information presented is based on publicly available data and should not be considered financial advice.

Current Broadcom Stock Price

As of [Insert Current Date and Time], Broadcom’s stock price is [Insert Current Stock Price]. The day’s high was [Insert Day’s High], and the low was [Insert Day’s Low]. The trading volume for the day is currently at [Insert Trading Volume]. These figures are subject to change throughout the trading day.

Broadcom Stock Price Movement Today

Broadcom’s stock price has experienced a [Insert Percentage Change]% change from yesterday’s closing price of [Insert Yesterday’s Closing Price]. The overall trend throughout the trading day has been [Insert Trend Description, e.g., relatively stable, upward trending, downward trending]. Compared to major market indices, Broadcom’s performance today is [Insert Comparison to S&P 500 and Nasdaq, e.g., in line with, outperforming, underperforming].

This comparison considers the percentage changes of the respective indices.

Factors Influencing Broadcom Stock Price

Several factors contribute to Broadcom’s stock price fluctuations. Three key factors influencing the price today are discussed below.

| Factor | Description | Impact on Price | Source |

|---|---|---|---|

| Overall Market Sentiment | Broader market trends, investor confidence, and economic indicators significantly influence stock prices across sectors, including technology. | Positive market sentiment generally leads to higher stock prices; negative sentiment can cause declines. | Financial News Outlets |

| Recent Earnings Reports | Strong or weak quarterly earnings reports can impact investor confidence and influence buying or selling pressure. | Positive earnings surprises typically boost stock prices, while negative surprises can lead to declines. | Broadcom’s Quarterly Earnings Reports |

| Industry Competition | Competition within the semiconductor industry can impact Broadcom’s market share and profitability, which in turn affects its stock price. | Increased competition can put downward pressure on prices, while market dominance can lead to price increases. | Market Research Reports |

Broadcom Stock Price Historical Data

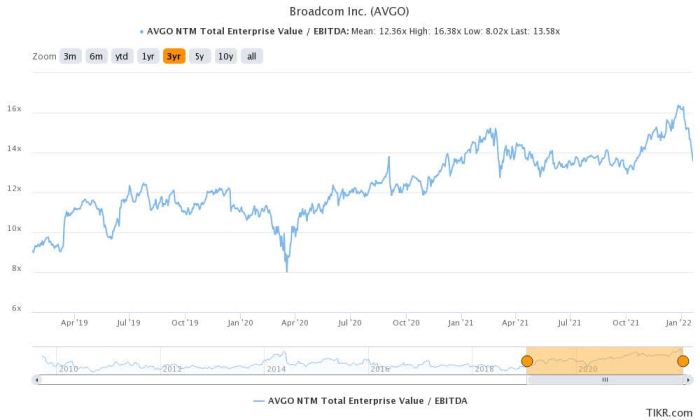

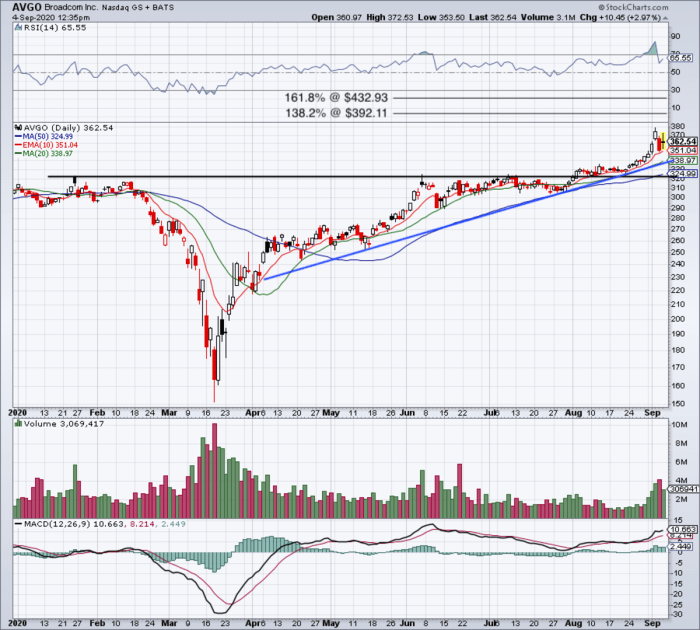

Source: seekingalpha.com

Broadcom’s stock price performance has shown volatility over various timeframes.

| Time Period | Opening Price | Closing Price | Percentage Change |

|---|---|---|---|

| Past Week | [Insert Data] | [Insert Data] | [Insert Data] |

| Past Month | [Insert Data] | [Insert Data] | [Insert Data] |

| Past Year | [Insert Data] | [Insert Data] | [Insert Data] |

Over the past year, Broadcom’s stock price has experienced significant fluctuations, reaching a high of [Insert High] and a low of [Insert Low]. The price movement has generally followed a [Insert General Trend, e.g., upward, downward, sideways] trend, with periods of both sharp increases and decreases. For example, a significant price drop occurred around [Insert Date/Event] due to [Insert Reason].

Conversely, a notable price surge was observed around [Insert Date/Event] following [Insert Reason].

Broadcom’s Financial Performance, Broadcom stock price today

Broadcom’s most recent quarterly earnings report revealed [Insert Summary of Key Highlights, e.g., strong revenue growth, increased profitability, positive outlook]. Compared to the previous quarter, revenue [Insert Change, e.g., increased, decreased] by [Insert Percentage] and profits [Insert Change, e.g., increased, decreased] by [Insert Percentage]. This financial performance [Insert Impact on Stock Price, e.g., positively impacted, negatively impacted] investor sentiment and contributed to the recent stock price movement.

Analyst Ratings and Predictions

Source: thestreet.com

Analyst sentiment towards Broadcom is currently [Insert Overall Sentiment, e.g., positive, mixed, negative]. A summary of recent ratings and price targets includes [Insert Summary of Ratings and Price Targets, e.g., a majority of analysts have a ‘buy’ rating with an average price target of X]. Differences in ratings and predictions stem from varying interpretations of Broadcom’s financial performance, growth prospects, and market conditions.

For example, some analysts highlight [Insert Positive Factor] while others express concerns about [Insert Negative Factor].

Comparison to Competitors

Compared to its main competitors, such as [Insert Competitor Names], Broadcom’s stock performance has [Insert Comparison, e.g., outperformed, underperformed, been comparable to] others in the semiconductor industry. [Insert Description of Similarities and Differences in Stock Price Movements, e.g., While all companies experienced volatility, Broadcom showed greater resilience during periods of market downturn]. These differences can be attributed to factors such as [Insert Potential Reasons, e.g., differences in market share, product diversification, technological advancements, and overall financial health].

Helpful Answers: Broadcom Stock Price Today

What are the typical trading hours for Broadcom stock?

Broadcom stock trades on the NASDAQ, generally following standard US stock market hours (9:30 AM to 4:00 PM ET).

Where can I find real-time Broadcom stock quotes?

Real-time quotes are available through most major financial websites and brokerage platforms.

How often are Broadcom’s earnings reports released?

Broadcom typically releases its quarterly earnings reports on a regular schedule, usually announced in advance.

What are the major risks associated with investing in Broadcom stock?

Risks include general market volatility, competition within the semiconductor industry, and dependence on specific technological advancements.