Allstate Home Auto Insurance offers a comprehensive range of protection for your vehicles and home. This coverage extends beyond basic needs, addressing a variety of potential risks. Understanding the nuances of different policy options is key to making the right choice for your specific circumstances.

Source: gethomeownersinsurance.net

From property damage to liability concerns, the insurance policy provides essential security. This overview delves into the specific aspects of the policy, exploring its advantages and potential limitations. Choosing the right policy is crucial for safeguarding your financial well-being.

Allstate is a major player in the US insurance market, offering a wide range of coverage options, including home and auto insurance. This detailed guide explores the key aspects of Allstate’s home and auto insurance policies, providing a comprehensive understanding of their features, benefits, and potential drawbacks. We’ll delve into coverage details, pricing strategies, customer reviews, and frequently asked questions to help you make an informed decision about whether Allstate is the right choice for your insurance needs.

Source: insuranceproviders.com

Understanding Allstate Home Insurance

Allstate home insurance policies provide protection against various risks, including fire, theft, vandalism, and weather-related damage. A key consideration is the specific coverage options offered, which can vary based on your location and the unique characteristics of your home. Understanding the different types of coverage available, like dwelling coverage, personal property coverage, and liability coverage, is essential. You should also consider add-on options like flood insurance, which isn’t typically included in standard policies.

Key Features and Benefits of Allstate Home Insurance

- Dwelling Coverage: Protects the structure of your home against covered perils.

- Personal Property Coverage: Insures your belongings inside the home against loss or damage.

- Liability Coverage: Provides financial protection if someone is injured on your property or if your actions cause damage to another’s property.

- Optional Add-ons: Flood insurance, earthquake coverage, and other specialized protections are available as add-ons.

- Discounts: Allstate often offers discounts for homeowners with multiple policies or those who maintain a good claims history.

Factors Influencing Allstate Home Insurance Premiums, Allstate home auto insurance

Several factors affect the cost of your Allstate home insurance policy. These include your home’s value, location, construction materials, and the presence of security systems or features that reduce risk. Additionally, claims history and your credit score can play a role.

Allstate Auto Insurance: A Deep Dive: Allstate Home Auto Insurance

Allstate’s auto insurance policies cover various aspects of vehicle ownership, including liability, collision, and comprehensive coverage. Choosing the right coverage level is crucial to protecting yourself and your vehicle.

Key Features and Benefits of Allstate Auto Insurance

- Liability Coverage: Protects you if you cause an accident and are legally responsible for damages to another person or their property.

- Collision Coverage: Pays for damages to your vehicle regardless of who is at fault.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events, such as vandalism, fire, or theft.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage.

Factors Affecting Allstate Auto Insurance Costs

Your age, driving history, vehicle type, and location are all important factors in determining your Allstate auto insurance premiums. Discounts are also available for safe driving, anti-theft devices, and good student programs.

Comparing Allstate with Competitors

Comparing Allstate with other major insurance providers like Geico, State Farm, and Progressive is crucial. Consider factors such as pricing, coverage options, customer service, and reputation. Online reviews and comparison websites can provide valuable insights.

Frequently Asked Questions (FAQ)

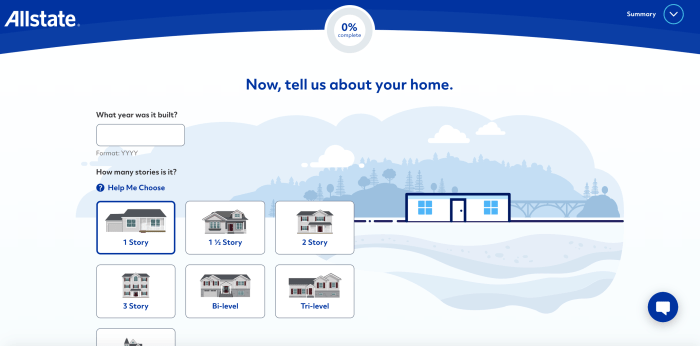

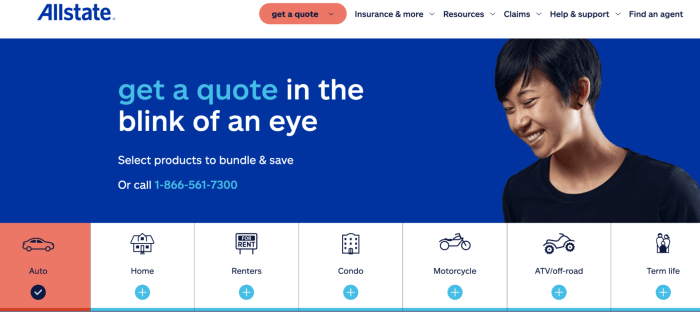

- Q: How do I get a quote for Allstate home and auto insurance?

- A: You can obtain quotes online through Allstate’s website or by contacting an Allstate agent.

- Q: What are the typical discounts offered by Allstate?

- A: Discounts may include safe driver programs, multiple policy discounts, and more.

- Q: What should I do if I have a claim with Allstate?

- A: Contact Allstate as soon as possible to report your claim and gather necessary documentation.

Conclusion

Allstate offers a substantial range of insurance products. Thorough research and comparison shopping are essential before selecting an insurance policy that meets your individual needs and budget. Considering your specific circumstances and preferences is key to making the right decision for your home and auto protection.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial professional or insurance agent for personalized guidance.

Sources

- Allstate Website: [Link to Allstate Website]

- Insurance Information Institute: [Link to Insurance Information Institute]

- Consumer Reports: [Link to Consumer Reports Insurance Reviews]

Call to Action (CTA): Get a free quote today and see how Allstate can protect your home and auto! [Link to Allstate Quote Page]

In conclusion, Allstate Home Auto Insurance provides a robust safety net against potential financial losses. By carefully reviewing the different coverage options and understanding the policy specifics, individuals can select the best possible protection. Ultimately, responsible planning and careful selection of the right insurance package are paramount.

FAQ Guide

What is the typical deductible for Allstate Home Auto Insurance?

The deductible for Allstate Home Auto Insurance varies depending on the specific policy and coverage chosen. It’s best to consult Allstate’s website or contact a representative for the most accurate and up-to-date information.

Does Allstate offer discounts for safe driving habits?

Source: storyblok.com

Yes, Allstate often provides discounts for drivers who maintain a safe driving record, including those with accident-free driving histories or participation in defensive driving courses.

How long does the claim process typically take with Allstate?

Allstate aims to process claims efficiently. However, the timeframe can vary depending on the complexity of the claim and the availability of supporting documentation.

Are there specific requirements for reporting accidents to Allstate?

Yes, Allstate requires immediate notification of any accidents involving your vehicle, along with specific documentation to expedite the claims process. Contacting Allstate as soon as possible after an accident is vital.