SBLI life insurance quote: Understanding your options is crucial for securing your financial future. This guide explores the various aspects of SBLI life insurance, providing a comprehensive overview to help you make informed decisions.

Different types of SBLI life insurance policies cater to various needs and budgets. This overview will walk you through the key features and benefits of each plan to help you find the right fit.

Getting a life insurance quote can feel daunting, especially with the many options available. This guide will delve into SBLI life insurance quotes, explaining the key factors involved, and helping you navigate the process with confidence. We’ll explore what influences the cost, how to compare quotes effectively, and what to look for in a policy. This comprehensive guide is designed to be easy to understand for anyone considering life insurance.

What is SBLI Life Insurance?

SBLI, or Singaporean-based Life Insurance, is a broad term encompassing various life insurance products offered by different companies in Singapore. These policies typically provide financial protection for your loved ones in the event of your death. Understanding the specifics of your needs and the various types of SBLI plans is crucial before obtaining a quote.

Key Features of SBLI Policies

- Death Benefit: The primary benefit, paying a lump sum to your beneficiaries.

- Term Life Insurance: Covers a specific period, often with a fixed premium.

- Permanent Life Insurance: Provides lifelong coverage with premiums that continue for the policyholder’s lifetime.

- Critical Illness Cover: Pays a benefit if you’re diagnosed with a critical illness.

- Accidental Death and Disability Benefit: Provides extra coverage if death or disability occurs due to an accident.

Factors Affecting Your SBLI Life Insurance Quote

Several factors influence the cost of your SBLI life insurance quote. These include:

Age and Health

Generally, younger individuals are eligible for lower premiums due to their lower risk of death. Health conditions, such as pre-existing medical conditions, will significantly affect your quote.

Coverage Amount

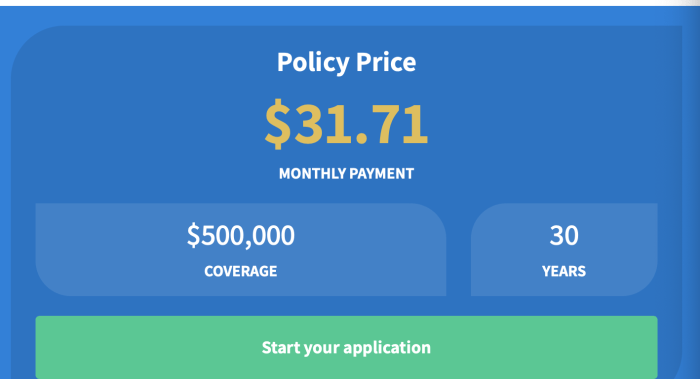

The amount of coverage you choose directly impacts the premium. Higher coverage amounts usually result in higher premiums.

Policy Term

Term life insurance policies with longer terms often have higher premiums compared to shorter-term policies. Permanent life insurance policies, with their lifelong coverage, typically have higher premiums than term policies.

Lifestyle and Habits

Certain lifestyle choices, like smoking, can impact your quote due to increased health risks. Professional occupation can also influence the premiums.

Add-on Benefits

Adding riders or add-on benefits, such as critical illness cover, will increase the premium cost.

How to Compare SBLI Life Insurance Quotes

Comparing quotes from different insurance providers is essential to get the best value for your money. Consider these steps:

Gather Information

Identify your needs and desired coverage amount, policy term, and any additional benefits you want.

Seek Quotes from Multiple Providers

Don’t limit yourself to one or two companies. Get quotes from a variety of SBLI providers to compare.

Analyze the Quotes Carefully, Sbli life insurance quote

Pay attention to the premium costs, coverage details, and policy terms. Compare the different options based on your specific needs.

Evaluate Riders and Add-ons

Consider the costs and benefits of any additional riders you might need. Do the benefits justify the additional premium cost?

Frequently Asked Questions (FAQ): Sbli Life Insurance Quote

- Q: How do I get a free life insurance quote?

A: Many insurance providers offer online quote calculators or allow you to request a quote via their websites.

- Q: What is the difference between term and permanent life insurance?

A: Term life insurance covers a specific period, while permanent life insurance offers lifelong coverage. The premiums and benefits differ significantly.

- Q: How long does it take to get a life insurance policy?

A: The processing time can vary depending on the insurance provider and the complexity of your application.

- Q: What is the role of a financial advisor in this process?

A: A financial advisor can help you assess your needs, compare quotes, and select the best policy for your financial goals.

Conclusion and Call to Action

Understanding SBLI life insurance quotes is crucial for making informed decisions about your financial security. By considering the factors that affect your quote, comparing policies from various providers, and carefully evaluating your needs, you can choose the right life insurance plan for your situation. Take the first step towards securing your future and protecting your loved ones by requesting a quote today.

Contact us for personalized advice and assistance in finding the perfect life insurance solution for you.

In conclusion, obtaining an SBLI life insurance quote is a significant step toward protecting your loved ones and securing your financial future. By carefully considering your options and needs, you can choose the best policy to meet your unique circumstances. Remember to thoroughly review all terms and conditions before making a decision.

Source: insuranceforburial.com

Q&A

What are the different types of SBLI life insurance policies available?

SBLI offers various plans, including term life insurance, whole life insurance, and universal life insurance, each with its own features and benefits.

What factors influence the cost of an SBLI life insurance quote?

Factors like your age, health, lifestyle, and desired coverage amount all play a role in determining the premium for your SBLI life insurance quote.

Source: googleusercontent.com

How long does it take to get an SBLI life insurance quote?

The timeframe for receiving a quote varies depending on the insurance provider and the complexity of your application. Generally, it can take a few days to a few weeks.

Can I compare quotes from different SBLI insurance providers?

Yes, comparing quotes from various SBLI providers is highly recommended to find the most suitable policy at the best possible price.